It’s an obvious assumption that car insurance companies want to keep you from comparing prices. People who shop around for cheaper prices will most likely switch companies because the odds are good of finding lower rate quotes. A study showed that consumers who compared rate quotes regularly saved about $865 annually compared to policyholders who never shopped around.

If finding budget-friendly rates on car insurance is the reason for your visit, then having a good understanding how to get rate quotes and compare car insurance can make the process more efficient.

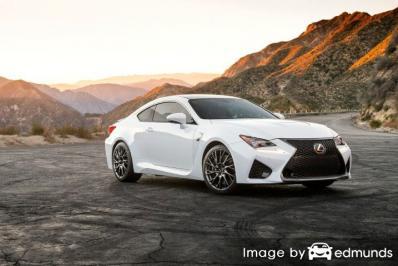

It takes a few minutes, but the best way to quote cheaper Lexus RC F insurance in Irvine is to do an annual price comparison from providers that sell auto insurance in California.

It takes a few minutes, but the best way to quote cheaper Lexus RC F insurance in Irvine is to do an annual price comparison from providers that sell auto insurance in California.

First, try to comprehend individual coverages and the things you can control to lower rates. Many rating factors that are responsible for high rates like distracted driving and an unacceptable credit history can be rectified by making minor changes to your lifestyle.

Second, get rate quotes from exclusive agents, independent agents, and direct providers. Exclusive agents and direct companies can only provide price estimates from a single company like GEICO and State Farm, while agents who are independent can quote rates for a wide range of insurance providers.

Third, compare the new rates to your existing rates to determine if switching companies saves money. If you find a lower rate and decide to switch, make sure there is no lapse in coverage.

An important part of this process is that you’ll want to make sure you compare identical deductibles and limits on each quote and and to get prices from as many different companies as possible. Doing this enables a fair rate comparison and the best price selection.

The companies shown below offer comparison quotes in Irvine, CA. If you want to find cheap car insurance in Irvine, we suggest you visit several of them to get a more complete price comparison.

Three good reasons to insure your Lexus vehicle

Despite the potentially high cost of Lexus RC F insurance, buying auto insurance serves several important purposes.

- Most states have minimum mandated liability insurance limits which means it is punishable by state law to not carry a minimum amount of liability insurance in order to get the vehicle licensed. In California these limits are 15/30/5 which means you must have $15,000 of bodily injury coverage per person, $30,000 of bodily injury coverage per accident, and $5,000 of property damage coverage.

- If your Lexus RC F has a lienholder, most banks will make it mandatory that you carry insurance to protect their interest in the vehicle. If you cancel or allow the policy to lapse, the bank or lender will purchase a policy for your Lexus for a lot more money and force you to reimburse them for it.

- Insurance protects both your car and your assets. It will also cover hospital and medical expenses for you, any passengers, and anyone injured in an accident. Liability insurance, one of your policy coverages, will also pay for a defense attorney if you are named as a defendant in an auto accident. If damage is caused by hail or an accident, collision and comprehensive coverages will pay to restore your vehicle to like-new condition.

The benefits of insuring your RC F more than offset the price you pay, particularly when you have a large claim. On average, a vehicle owner in Irvine is wasting up to $825 a year so compare rate quotes at least once a year to make sure the price is not too high.

Learn How to Lower Your Insurance Prices

Multiple criteria are used when premium rates are determined. A few of the factors are predictable such as traffic violations, although others are more obscure like your continuous coverage or how safe your car is. One of the most helpful ways to save on insurance is to to have a grasp of some of the factors that help calculate your insurance rates. When you understand what determines premiums, this allows you to make good choices that may reward you with better insurance rates.

- Insurance costs are higher for high performance vehicles – The performance of the car you are insuring makes a huge difference in your rates. The most favorable rates tend to be for low performance passenger cars, but other factors influence the final cost greatly.

- Use one insurance company and save – Most major insurance companies apply better rates to insureds who carry more than one policy in the form of a multi-policy discount. Even if you qualify for this discount already, consumers should still check prices from other companies to verify if the discount is saving money.There is a chance you can save even more by insuring with multiple companies.

- Adjust deductibles and save – Deductibles for physical damage are the amount of money you are required to spend out-of-pocket if the claim is covered. Protection for physical damage, termed comprehensive and collision coverage on your policy, protects your car from damage. Some coverage claims would be colliding with a stationary object, animal collisions, and damage caused by road hazards. The higher the amount you’re willing to pay, the less your company will charge you for insurance.

- Employer can influence rates – Did you know your occupation can influence how much you pay for insurance? Occupational choices like real estate brokers, police officers, and stock brokers tend to have higher average rates in part from high stress levels and lots of time spent at work. On the other hand, careers like scientists, students and retirees pay lower than average rates.

- Improve your credit history and save – Having a good credit history is a big factor in determining premium rates. Therefore, if your credit can be improved, you could save money insuring your Lexus RC F by taking the time to improve your credit score. Insureds with excellent credit scores tend to be better drivers and file fewer claims than drivers with bad credit.

These discounts can cut Lexus RC F insurance rates

Not too many consumers would say auto insurance is affordable, but you might be missing out on some discounts that could drop your premiums quite a bit. Most are applied when you get a quote, but a few need to be specially asked for before being credited.

- Mature Driver Discount – Drivers over the age of 55 can get better auto insurance rates.

- No Accidents – Drivers who don’t have accidents get the best auto insurance rates as compared to accident-prone drivers.

- Own a Home and Save – Being a homeowner can earn you a little savings because owning a home is proof that your finances are in order.

- Air Bag Discount – Factory air bags and/or automatic seat belt systems may qualify for discounts of 25 to 30%.

- Early Switch Discount – Some insurance companies provide a discount for renewing your policy prior to the expiration date on your current RC F insurance policy. Ten percent is about the average savings.

- Anti-theft System – Anti-theft and alarm system equipped vehicles prevent vehicle theft and can earn a small discount on your policy.

- Discounts for New Vehicles – Insuring a new RC F can save up to 30% because new vehicles keep occupants safer.

- Save with More Vehicles Insured – Drivers who insure several vehicles with the same company can get a discount for every vehicle.

Discounts reduce rates, but you should keep in mind that most of the big mark downs will not be given to the entire cost. Some only apply to specific coverage prices like physical damage coverage or medical payments. So when the math indicates all the discounts add up to a free policy, it’s just not the way it works.

Large auto insurance companies and some of the discounts are:

- Progressive policyholders can earn discounts including continuous coverage, online quote discount, multi-policy, multi-vehicle, good student, and online signing.

- SAFECO may include discounts for homeowner, anti-theft, teen safe driver, bundle discounts, and drive less.

- American Family offers discounts for bundled insurance, Steer into Savings, air bags, accident-free, multi-vehicle, mySafetyValet, and TimeAway discount.

- MetLife includes discounts for claim-free, good student, defensive driver, good driver, and multi-policy.

- GEICO offers premium reductions for daytime running lights, good student, anti-lock brakes, multi-vehicle, and emergency military deployment.

- The Hartford has savings for air bag, defensive driver, anti-theft, driver training, and good student.

When quoting, ask every company the best way to save money. Discounts might not be available to policyholders in your state.

Insurance agencies near you

Certain consumers just want to sit down with an agent and that is OK! Good agents can help you choose the best coverages and will help you if you have claims. The biggest benefit of getting free rate quotes online is you can get lower rates and still have a local agent.

By using this short form, the quote information gets sent to insurance agents in Irvine who will return price quotes for your insurance coverage. You won’t need to search for an agent because prices are sent to you instantly. If you wish to get a price quote from a specific auto insurance provider, don’t hesitate to search and find their rate quote page and give them your coverage information.

By using this short form, the quote information gets sent to insurance agents in Irvine who will return price quotes for your insurance coverage. You won’t need to search for an agent because prices are sent to you instantly. If you wish to get a price quote from a specific auto insurance provider, don’t hesitate to search and find their rate quote page and give them your coverage information.

Finding the right provider requires more thought than just the quoted price. These are some valid questions you should ask.

- What is the financial rating for the quoted company?

- Does the quote include credit and driving reports?

- Are there any extra charges for paying monthly?

- Do you work with a CSR or direct with the agent?

- Do you have coverage for a rental car if your vehicle is in the repair shop?

- Do they receive special compensation for putting your coverage with one company over another?

- Do they have any clout with companies to ensure a fair claim settlement?

If you would like to find a reliable insurance agent, you should know the different agency structures from which to choose. Auto insurance policy providers are either exclusive or independent (non-exclusive). Both types can sell and service auto insurance coverage, but it’s important to know how they are different because it can factor into your selection of an agent.

Exclusive Agencies

Exclusive insurance agents can only quote rates from one company such as AAA, Allstate, and State Farm. Exclusive agents cannot provide prices from multiple companies so they have to upsell other benefits. Exclusive agencies are trained well on their company’s products which helps offset the inability to provide other markets. Some people will only purchase coverage from exclusives mostly because of loyalty to the company rather than having the cheapest rates.

The following is a short list of exclusive agencies in Irvine who may provide you with price quotes.

- Rebecca Higgs – State Farm Insurance Agent

5410 Trabuco Rd #100 – Irvine, CA 92620 – (949) 726-9015 – View Map - Farmers Insurance

4000 Barranca Pkwy # 250 – Irvine, CA 92604 – (949) 262-3238 – View Map - State Farm Insurance Agent: Kevin Chhiv

2101 Business Center Dr Suite 110 – Irvine, CA 92612 – (949) 202-0338 – View Map

Independent Auto Insurance Agents

These agents do not work for one specific company so they have the ability to put coverage amongst many companies and get you the best rates possible. If premiums increase, your agent can switch companies and you don’t have to find a new agent. If you need cheaper auto insurance rates, we recommend you check rates from at a minimum one independent agency to get the most accurate price comparison. Many can place coverage with smaller companies that may have much lower rates than larger companies.

Shown below is a list of independent insurance agents in Irvine that can give you price quote information.

- KCAL Insurance Agency (Irvine)

14795 Jeffrey Rd – Irvine, CA 92618 – (949) 786-6888 – View Map - Tustin Insurance Agency

17621 Irvine Blvd #112 – Tustin, CA 92780 – (714) 838-1704 – View Map - Journey Insurance

9541 Irvine Center Dr – Irvine, CA 92618 – (888) 323-7480 – View Map

Once you have received good feedback and an acceptable price quote, you’ve probably found an auto insurance agent that will adequately provide auto insurance.

How to find a good Irvine auto insurance company

Picking the right car insurance company can be challenging considering how many choices there are in Irvine. The company information displayed below could help you pick which insurers you want to consider comparing prices from.

Top 10 Irvine Car Insurance Companies Ranked by Customer Service

- AAA of Southern California

- GEICO

- State Farm

- The Hartford

- Mercury Insurance

- The General

- Progressive

- Allstate

- AAA Insurance

- American Family

Top 10 Irvine Car Insurance Companies by A.M. Best Rank

- USAA – A++

- Travelers – A++

- State Farm – A++

- GEICO – A++

- Esurance – A+

- Nationwide – A+

- Allstate – A+

- Mercury Insurance – A+

- Progressive – A+

- Titan Insurance – A+

Cheaper car insurance is a realistic goal

Discount Lexus RC F insurance in Irvine can be purchased online in addition to local insurance agencies, and you need to price shop both to have the best selection. Some companies may not offer online quoting and these regional insurance providers sell through local independent agents.

You just read many ideas to lower your Lexus RC F insurance auto insurance rates in Irvine. The key thing to remember is the more price quotes you have, the higher your chance of finding the cheapest Lexus RC F rate quotes. Drivers may even discover the most savings is with the smaller companies.

Insureds switch companies for any number of reasons including an unsatisfactory settlement offer, policy cancellation, policy non-renewal and even delays in responding to claim requests. Regardless of your reason for switching companies, switching car insurance companies is not as hard as you think.

Additional information is available at these links:

- Auto Insurance Basics (Insurance Information Institute)

- What Car Insurance is Cheapest for College Graduates in Irvine? (FAQ)

- Who Has Cheap Irvine Auto Insurance for a Toyota Tundra? (FAQ)

- What Insurance is Cheapest for Nurses in Irvine? (FAQ)

- Who Has Cheap Auto Insurance for a Ford Explorer in Irvine? (FAQ)

- What Insurance is Cheapest for Uber Drivers in Irvine? (FAQ)

- Who Has Cheap Auto Insurance for a Toyota Camry in Irvine? (FAQ)

- Who Has Cheap Auto Insurance Rates for a 20 Year Old Male in Irvine? (FAQ)

- What Determines the Price of My Auto Insurance Policy? (Insurance Information Institute)

- If I File a Claim will My Insurance Go Up? (Insurance Information Institute)