I can’t think of a single person who rejoices having to buy insurance, particularly when the prices are way too high.

I can’t think of a single person who rejoices having to buy insurance, particularly when the prices are way too high.

A recent study showed that the majority of drivers have stayed with the same insurance company for well over three years, and practically 40% of insurance customers have never taken the time to shop around. U.S. consumers can save hundreds of dollars each year, but they underestimate how much money they would save if they bought a different policy.

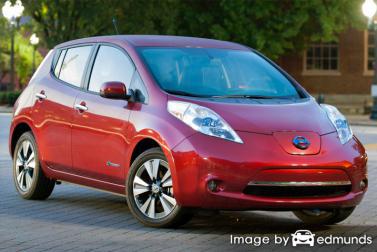

How to find cheaper quotes for Nissan Leaf insurance in Irvine

Truthfully, the best way to get the cheapest Nissan Leaf insurance in Irvine is to make a habit of comparing prices annually from providers that sell auto insurance in California.

- Try to comprehend how companies set rates and the factors you can control to prevent expensive coverage. Many rating criteria that cause high rates such as at-fault accidents, speeding tickets, and a low credit rating can be eliminated by making small lifestyle or driving habit changes. Keep reading for additional ideas to help keep rates affordable and find hidden discounts.

- Quote rates from exclusive agents, independent agents, and direct providers. Exclusive agents and direct companies can only provide price estimates from a single company like Progressive or Allstate, while agents who are independent can quote rates from many different companies. Get quotes now

- Compare the price quotes to the premium of your current policy and determine if there is any savings. If you find a better price and make a switch, make sure there is no coverage gap between policies.

- Notify your current company of your intention to cancel your current auto insurance policy. Submit a completed application and payment to the newly selected company. As soon as you have the new policy, put the proof of insurance paperwork with the vehicle registration.

One important bit of advice is to try to compare the same physical damage deductibles and liability limits on each quote and and to get price estimates from as many car insurance companies as possible. This helps ensure the most accurate price comparison and a complete selection of prices.

Drivers have so many car insurance companies to buy insurance from, and though it is a good thing to have a selection, it can be more challenging to find the lowest cost provider for Nissan Leaf insurance in Irvine.

Affordable rates with discounts

Companies don’t always advertise every available discount very well, so we break down both the well known as well as some of the hidden credits available to you.

- Seat Belt Usage – Drivers who always wear seat belts and also require passengers to fasten their seat belts can save 10% or more on the medical payments or PIP coverage costs.

- Low Mileage Discounts – Maintaining low annual mileage can qualify you for substantially lower rates.

- Early Signing – A few companies give discounts for buying a new policy early. You could save around 10% when you buy Irvine car insurance online.

- Theft Deterrent System – Vehicles that have factory alarm systems and tracking devices are stolen less frequently and will qualify for a discount on a Irvine car insurance quote.

- Policy Bundle Discount – If you can combine your auto and homeowners policy and insure them both with the same insurance company you could earn a discount of up to 20% and get you cheaper Leaf insurance.

- Drivers Education – Teen drivers should successfully take a driver’s education course if offered at their school.

- Defensive Driver Discount – Participating in a course teaching safe driver skills could possibly earn you a 5% discount and also improve your driving technique.

While discounts sound great, it’s important to understand that some credits don’t apply to the whole policy. The majority will only reduce specific coverage prices like comp or med pay. If you do the math and it seems like you would end up receiving a 100% discount, that’s just not realistic.

A list of companies and a summarized list of policyholder discounts can be found below.

- Travelers has savings for payment discounts, new car, continuous insurance, IntelliDrive, good student, multi-car, and student away at school.

- 21st Century offers discounts for student driver, homeowners, teen driver, 55 and older, good student, automatic seat belts, and early bird.

- State Farm has discounts for multiple policy, passive restraint, anti-theft, accident-free, and driver’s education.

- GEICO may have discounts that include seat belt use, membership and employees, driver training, multi-policy, defensive driver, and air bags.

- SAFECO may offer discounts for safe driver, multi-car, teen safety rewards, bundle discounts, and anti-lock brakes.

- AAA offers premium reductions for multi-policy, anti-theft, AAA membership discount, good driver, and pay-in-full.

It’s a good idea to ask each company or agent how you can save money. Some of the discounts discussed earlier might not apply in Irvine. For a list of insurance companies that offer some of these discounts in California, click here to view.

The best way we recommend to get rate comparisons for Nissan Leaf insurance in Irvine utilizes the fact most insurance companies pay for the opportunity to provide you with a free rate quote. To begin a comparison, all you need to do is give them rating details such as if you lease or own, the year, make and model of vehicles, driver ages, and level of coverage desired. That rating information is automatically sent to all major companies and they return rate quotes instantly to find the best rate.

If you would like to start a quote now, click here and complete the quick form.

The following companies are our best choices to provide price quotes in California. If you want cheaper auto insurance in Irvine, CA, we suggest you visit as many as you can in order to get a fair rate comparison.

You may need advice from a local insurance agent

Some consumers just prefer to talk to an insurance agent and that is a smart decision A good thing about getting online price quotes is the fact that drivers can get cheaper rates and still have a local agent.

After completing this short form, the coverage information is instantly submitted to local insurance agents in Irvine that can give you free Irvine car insurance quotes to get your business. You won’t even need to search for any insurance agencies as quotes are delivered to the email address you provide. You’ll get the best rates AND a local agent. In the event you want to compare rates from one company in particular, you would need to search and find their rate quote page to submit a rate quote request.

After completing this short form, the coverage information is instantly submitted to local insurance agents in Irvine that can give you free Irvine car insurance quotes to get your business. You won’t even need to search for any insurance agencies as quotes are delivered to the email address you provide. You’ll get the best rates AND a local agent. In the event you want to compare rates from one company in particular, you would need to search and find their rate quote page to submit a rate quote request.

Finding the right company should depend on more than just the quoted price. Agents should be asked these questions:

- Do they offer rental car reimbursement?

- Who is covered by the car insurance policy?

- Do they reduce claim amounts on high mileage vehicles?

- Will the agent help in case of a claim?

- Are they able to provide referrals?

- Does the company allow you to choose your own collision repair facility?

- Are you getting all the discounts the company offers?

- What will you get paid if your car is a total loss? How is that amount determined?

Pick the best auto insurance agent in Irvine for you

If you would like to find a good Irvine insurance agent, it can be helpful to understand the types of insurance agents and how they can write your policy. Auto insurance agencies can be described as either independent or exclusive depending on the company they work for.

Exclusive Agents

Exclusive insurance agents can only place business with one company like Allstate and State Farm. Exclusive agents are unable to provide prices from multiple companies so they are skilled at selling on more than just price. Exclusive agents receive extensive training on their company’s products which aids in selling service over price.

Shown below are exclusive insurance agencies in Irvine willing to provide rate quotes.

Steven Wang – State Farm Insurance Agent

15333 Culver Dr #130 – Irvine, CA 92604 – (949) 552-3600 – View Map

Allstate Insurance: Kay Yang

4255 Campus Dr A270 – Irvine, CA 92612 – (949) 509-2888 – View Map

State Farm: Jane Lee

30 Corporate Park – Irvine, CA 92606 – (949) 223-5020 – View Map

Independent Auto Insurance Agencies

Independent agencies are not locked into one company and that is an advantage because they can write policies with any number of different companies depending on which coverage is best. If your premiums go up, your agent can switch companies which requires no work on your part.

If you are trying to find cheaper rates, it’s recommended you compare quotes from independent agents to have the best price comparison.

Below are Irvine independent insurance agencies that are able to give comparison quotes.

Roger Stone Insurance Agency

5015 Birch St – Newport Beach, CA 92660 – (949) 757-0270 – View Map

Gardner Insurance Orange County

4952 Warner Ave – Huntington Beach, CA 92649 – (714) 846-4231 – View Map

Church and Casualty Insurance

3440 Irvine Ave # 150 – Newport Beach, CA 92660 – (949) 852-8558 – View Map

Which auto insurance company is best in California?

Picking the top insurance company can be a challenge considering how many companies sell coverage in Irvine. The ranking information below can help you pick which car insurance providers to look at shopping prices with.

| Company | Value | Customer Service | Claims | Customer Satisfaction | A.M Best Rating | Overall Score |

|---|---|---|---|---|---|---|

| USAA | 98 | 100 | 100 | 94% | A++ | 98.6 |

| American Family | 98 | 89 | 100 | 86% | A | 95.4 |

| AAA of Southern California | 91 | 94 | 97 | 92% | A+ | 94.1 |

| State Farm | 88 | 93 | 96 | 90% | A++ | 92.4 |

| The Hartford | 94 | 92 | 90 | 89% | A+ | 91.7 |

| AAA Insurance | 88 | 89 | 95 | 91% | A | 91.2 |

| GEICO | 84 | 93 | 93 | 89% | A++ | 90.3 |

| The General | 89 | 91 | 89 | 88% | A- | 90 |

| Titan Insurance | 90 | 87 | 91 | 95% | A+ | 89.6 |

| Progressive | 84 | 91 | 93 | 87% | A+ | 89.5 |

| Mercury Insurance | 88 | 91 | 90 | 85% | A+ | 89.4 |

| Allstate | 85 | 90 | 92 | 88% | A+ | 89.3 |

| Nationwide | 87 | 88 | 84 | 90% | A+ | 88.7 |

| Liberty Mutual | 84 | 87 | 93 | 88% | A | 88.5 |

| 21st Century | 85 | 86 | 87 | 88% | A | 86.7 |

| Esurance | 85 | 80 | 95 | 87% | A+ | 85.9 |

| Safeco | 85 | 85 | 85 | 86% | A | 85.8 |

| Travelers | 80 | 87 | 87 | 83% | A++ | 85.2 |

| Farmers Insurance | 78 | 87 | 88 | 79% | A | 84.3 |

| Compare Rates Now Go | ||||||

Data Source: Insure.com Best Car Insurance Companies

Cheaper car insurance premiums are out there

Some insurance companies do not offer rate quotes online and many times these regional carriers only sell through independent insurance agencies. Budget-friendly car insurance in Irvine can be purchased from both online companies and from local insurance agents, so you need to compare both in order to have the best price selection to choose from.

As you shop your coverage around, it’s a bad idea to buy lower coverage limits just to save a few bucks. There are too many instances where an insured dropped uninsured motorist or liability limits only to find out that it was a big mistake. Your goal is to buy the best coverage you can find at a price you can afford while still protecting your assets.

Steps to saving money on Nissan Leaf insurance in Irvine

The most effective way to find discount car insurance rates is to make a habit of regularly comparing prices from insurers in Irvine.

- Gain an understanding of policy coverages and the modifications you can make to lower rates. Many rating criteria that increase rates like distracted driving and a lousy credit rating can be amended by making minor changes in your lifestyle.

- Request rate estimates from direct, independent, and exclusive agents. Direct companies and exclusive agencies can only give prices from a single company like GEICO or Allstate, while independent agencies can provide prices for many different companies. Select a company

- Compare the price quotes to your current policy to see if you can save by switching companies. If you find better rates, verify that coverage does not lapse between policies.

The key thing to know about shopping around is that you’ll want to compare identical limits and deductibles on each quote request and and to analyze as many car insurance companies as possible. This provides a fair rate comparison and a complete selection of prices.

Helpful learning opportunities

- What is a Telematics Device? (Allstate)

- Who Has Cheap Auto Insurance Quotes for a Ford Focus in Irvine? (FAQ)

- How Much are Irvine Car Insurance Quotes for Unemployed Drivers? (FAQ)

- Who Has Affordable Irvine Car Insurance Quotes for Drivers Under 21? (FAQ)

- Protect Yourself Against Auto Theft (Insurance Information Institute)

- Auto Crash Statistics (Insurance Information Institute)

- New Honda safety features benefit drivers of all ages (Insurance Institute for Highway Safety)